Understanding 5StarsStocks.com Lithium of Investment Trends via

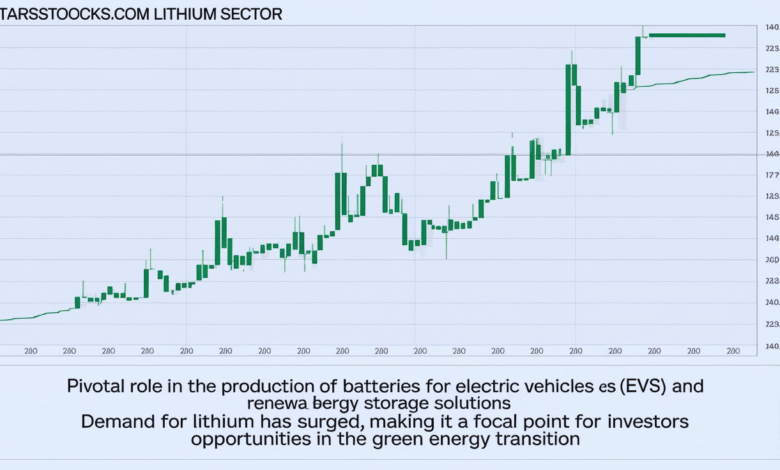

The 5StarsStocks.com lithium sector has attracted significant attention over the last few years due to lithium’s crucial role in powering electric vehicles (EVs) and renewable energy storage solutions. With the global shift towards sustainable energy, the demand for lithium continues to surge, making it a critical area for investors seeking high-growth opportunities.

5StarsStocks.com lithium provides investors with insights into key stocks and market trends, helping both beginners and experienced investors navigate this evolving sector. In this article, we explore the investment trends in 5StarsStocks.com lithium, how the platform identifies opportunities, and what factors shape the lithium market.

| Attribute | Details |

|---|---|

| Platform Name | 5StarsStocks.com |

| Sector Focus | Lithium, EV batteries, energy storage, technology, and other trending sectors |

| Founded | Information not publicly disclosed |

| Headquarters | Information not publicly disclosed |

| Core Offering | AI-driven stock analysis, curated stock recommendations, sector insights |

| Key Feature | Star-rating system for stock picks; thematic focus on sectors like lithium |

| Target Audience | Beginner and experienced investors looking for stock trends and sector opportunities |

| Investment Approach | Data-driven analysis using artificial intelligence; focus on lithium mining, battery manufacturing, and energy storage companies |

| Known Risks | Mixed performance of stock picks, volatility in lithium sector, reliance on AI predictions |

| Benefits | Access to curated lithium stock ideas, insights into market trends, simplified research process |

| Social Media Presence | Not publicly listed; users typically engage through the platform’s site |

| Website | 5StarsStocks.com |

The Growing Demand for Lithium

The importance of 5StarsStocks.com lithium is tied directly to the rising global demand for lithium-ion batteries. These batteries are central to EV technology, offering high energy density, long lifespan, and superior efficiency. As the world adopts electric mobility, lithium continues to emerge as a critical investment focus.

Beyond EVs, 5StarsStocks.com lithium covers companies involved in energy storage solutions, which are essential for integrating renewable energy like solar and wind. Efficient energy storage ensures a balance between supply and demand, further increasing interest in lithium-focused investments.

5StarsStocks.com Lithium Investment Approach

5StarsStocks.com lithium uses a data-driven approach, combining artificial intelligence and market analysis to identify high-potential stocks. The platform evaluates lithium mining companies, battery manufacturers, and energy storage innovators to provide actionable investment insights.

Investors looking at 5StarsStocks.com lithium can benefit from AI-powered analytics that highlight trends, growth potential, and emerging opportunities in the lithium sector. By focusing on lithium stocks, the platform helps investors stay informed about a key market driving the global energy transition.

Performance of 5StarsStocks.com Lithium Picks

While 5StarsStocks.com lithium offers valuable stock recommendations, performance varies. Some lithium-focused picks have shown substantial growth, with certain battery stocks appreciating significantly over short periods.

However, independent reviews indicate mixed results for 5StarsStocks.com lithium recommendations. A test revealed that only about 35% of stock picks were profitable over four months, highlighting the importance of conducting additional research before acting on the platform’s suggestions.

Factors Driving 5StarsStocks.com Lithium Investment Trends

Several key factors influence the 5StarsStocks.com lithium market trends:

- Technological Innovation: Advancements in lithium extraction and battery technology can significantly affect supply and demand dynamics.

- Geopolitical Events: Stability in major lithium-producing regions affects global supply chains and market pricing.

Additionally, environmental regulations and investor sentiment also play crucial roles in shaping 5StarsStocks.com lithium investment outcomes. Understanding these factors helps investors make more informed decisions when investing in lithium stocks.

Risks and Rewards of 5StarsStocks.com Lithium Investments

Investing in 5StarsStocks.com lithium offers both potential rewards and inherent risks:

Rewards:

- High Market Demand: Growth in EVs and renewable energy increases lithium consumption.

- Technological Advancements: Innovations in batteries and extraction can boost the profitability of lithium-focused companies.

Risks:

- Price Volatility: Lithium prices can fluctuate due to supply-demand changes and geopolitical events.

- Regulatory Challenges: Stricter environmental policies may impact production costs and operations.

Balancing these risks and rewards is essential for investors using 5StarsStocks.com lithium as a research and investment tool.

Conclusion

The 5StarsStocks.com lithium sector represents a promising avenue for investors seeking exposure to the growing EV and renewable energy markets. With AI-driven insights and curated stock recommendations, 5StarsStocks.com lithium offers guidance in navigating this dynamic industry.

Investors must complement the platform’s insights with independent research and diversification strategies. By doing so, 5StarsStocks.com lithium can serve as a valuable component of a well-informed investment approach, helping to capture opportunities in the booming lithium market.

Also Read More: MyFastBroker.com Review: Is It the Right Choice for You?

FAQs

1. What is 5StarsStocks.com lithium?

5StarsStocks.com lithium refers to the platform’s coverage and recommendations for stocks in the lithium sector, including mining, battery manufacturing, and energy storage.

2. How does 5StarsStocks.com lithium identify opportunities?

The platform uses artificial intelligence and market analytics to track trends, company performance, and emerging opportunities in the lithium sector.

3. Are 5StarsStocks.com lithium stock picks reliable?

While some lithium stocks have shown growth, independent tests report mixed performance, emphasizing the need for additional research.

4. What factors affect 5StarsStocks.com lithium investments?

Technological innovation, geopolitical stability, environmental regulations, and market sentiment are key factors influencing lithium investment trends.

5. How can investors manage risks with 5StarsStocks.com lithium?

Diversifying across sectors, conducting thorough research, and staying updated on market trends can help mitigate risks in 5StarsStocks.com lithium investments.